October 4, 2021

It’s an exciting time to be involved in the automotive manufacturing industry. A revolution of electrification is underway, but there is a growing hurdle for OEMs to meet capacity demand and manage the evolution of technology changes that are coinciding. Learn how ATS Industrial Automation continues to be the partner of choice for EV battery module assembly and testing.

In this recording from the ATS Virtual Expo 2021, Cameron Bruce explains:

- Why companies are changing their approach to battery module assembly and testing to manage design changes better.

- Why engaging your suppliers earlier is so crucial for today’s success.

- How applying continuous process improvements and a flexible automation approach bring product concepts to reality.

Watch “Electric Vehicle Challenges: Are You Prepared?” Webinar Now

Speaker

Speaker

Cameron Bruce

Mechanical Design Manager, ATS Industrial Automation.

Transcript

Good afternoon, and welcome to the virtual presentation, Electric Vehicle Challenges: Are You Prepared?

During this presentation, we’ll explore the challenges in the EV industry as we race towards volume production to meet demand, and discuss how every day matters. My name is Cameron Bruce. I’m a Mechanical Design Manager at ATS and I’ll be taking you through some of the challenges with the automotive transformation, from 100 plus years of the internal combustion engine, to the future market of EVs.

I’ve been part of the ATS team for over 15 years, designing automation in a variety of fields, including medical, nuclear, consumer products and traditional automotive programs. With the shift to EVs, opportunities rose to contribute to this new and exciting industry, and I took the lead role in a number of large-scale module and pack assembly projects. With experience in both cylindrical and pouch cell automation, I can tell you that this is not a simple problem to solve. And, it takes strong partnerships and creative solutions to get to production.

As an EV owner, I understand the appeal and benefits of an electrified future, and I’m convinced demand will outstrip supply for some time to come. And I’m not the only one who’s noticed. Companies all around the world, both traditional organizations and the disruptors, are racing to get ahead of the curve. It’s only a matter of time now, before EVs become the larger market segment in the passenger vehicle space. Combine this with other transportation demands, like commercial trucking and public transportation, as well as grid storage, and the demand on battery production is overwhelming.

My newsfeed is filled with a stream of EV initiatives and battery development projects. A quick search reveals the investment in battery production is well underway, and the automotive electrification revolution is already in full swing. In some cases, that revolution is already rolling, with new vehicles being launched each year. What were previously hybrid adaptations of existing platforms are now developing into full-blown electric platforms requiring larger battery packs, more cells and new manufacturing techniques.

Challenges

Rising Demand for EVs

In 2020, annual EV sales were approximately 3.2 million vehicles. But, in four short years from now, EV sales are expected to nearly quadruple as more supply comes online; the curve remains exponential for years into the future. And, let’s not forget that 2020 was not exactly a stable consumer market, with COVID-19 disruptions and a long-lasting microchip shortage. While 2021 has not been business as usual, projections already show a significant jump in EV sales from previous years. As we transition out of 2020 and the height of the pandemic, the EV market only seems to be accelerating.

More dramatic is the concept that all major automakers will need electric platforms by the end of the decade and be prepared for the transition, as the market shifts from an internal combustion engine to an EV platform. While EV sales are largely strongest in Europe, development in China is strong as that market continues to grow rapidly. In the US, EV sales growth continues to outpace traditional automotive platforms, and in the US, while the broader auto market saw a contraction of 15% last year, year-over-year, EVs realized a 4% market expansion.

It’s not just the private sector paying attention. Governments all around the world are implementing widespread initiatives to move all new vehicle sales to full electric by 2035 or sooner. For example, the UK will ban all new sales of gas vehicles by 2030, and in 2035, Canada, China and select states in the US will do the same, just to name a few jurisdictions.

My wife and I have two small children: they’re four and six. We live in Waterloo, Ontario, and are obviously keeping a close eye on Canada’s regulatory developments of EVs. For those of you with children or grandchildren at a similar age, in a jurisdiction with similar goals, consider this: by the time they reach the age to buy their first new car, gas powered cars won’t even be an option.

Lithium Ion and Solid-State: the Magic Triangle and Potential Disruption

The demand is real. Why is this a problem? Consider this magic triangle of factors converging to form a perfect storm for the supply chain capacity.

First, battery technology is changing and improving at a rapid pace. Lithium-ion is the core technology of today, with many recipe developments in the works to improve capacity, as well as charge discharge times. Solid-state batteries are on the horizon, and while none of them are ready for mainstream production yet, their arrival could shake up the existing supply chain as companies pivot to attain the most competitive technologies.

Secondly, battery assembly projects take two to three years from project start from RFP, request for proposal, or RFQ, request from quotation, to full production ramp-up. Batteries are complex and multidisciplinary programs requiring substantial capital and time investment. EV batteries are an integral part of vehicle design and need to have started production timing that aligns with the remainder of the vehicle chassis.

Third, automated assembly lines cannot be easily changed, and flexibility is not built into new battery designs. For example, what if solid-state batteries come to market? Will the existing product designs roll out the latest technology into a current form factor, or will these new batteries take on an entirely different shape? This makes automation projects a moving target and as a result, programs with more than 400 change orders are not uncommon in the production landscape today.

Battery packs are not a commodity; they require full vehicle system integration and analysis to be successful. And, with so many interdependent elements, change is inevitable. If the automation equipment cannot adapt to the evolving product, tooling can quickly become obsolete. This could throw the development of an electrification program into chaos and put the automaker behind the eight-ball when others are rapidly consuming larger segments of the market.

Sourcing Production Space

Battery pack assembly is not a solved problem, and there is a lack of capable supply base to mitigate supply chain risks. Not addressing these risks in early development can leave some automakers with nowhere to turn if plan A does not work. And, those risks are undoubtably real. As an example, the floor space alone to launch these new programs is daunting.

In 2020, a battery module line with an annual production volume of 530,000 units, or 30,000 battery electric vehicles, occupied the same total footprint as an Olympic-sized swimming pool. In 2021, multiple module production lines with a total output of 1 million modules, supporting an annual vehicle production of 100,000 units, required two full soccer pitches; that was just to do modules. To get the modules in the packs, the equivalent of an additional 19 basketball courts was laid out for that same program. All in all, producing 100,000 high-mileage vehicles annually consumed just over 22,000 square meters, or nearly 240,000 square feet. Massive battery facilities are already under construction, with some being new builds and others choosing to repurpose existing traditional automotive space for a renewed manufacturing purpose.

But, can all this floorspace capacity, not to mention tooling to fit into these buildings, be sourced in time? Think back to where EV sales are going: if EV sales are going to hit 12 million units annually by 2025, and with the understanding that today’s production lines are capable of producing roughly 100,000 units per year, a total of 120 full battery pack production lines will be required.

Then, consider that the area required for a high-mileage production line is around 240,000 square feet. That equates to a total floorspace capacity of 29 million square feet, or about three quarters of Central Park in New York City. Finally, considering that started production is a two to three-year lifecycle, you can quickly see planning for footprint on the assembly floor is critical. But also consider that to meet that timing, the floor space required is on the automation suppliers within the next year. These companies need to procure new space to accommodate the customer demands, and don’t necessarily have the option to repurpose existing facilities to take on this workload.

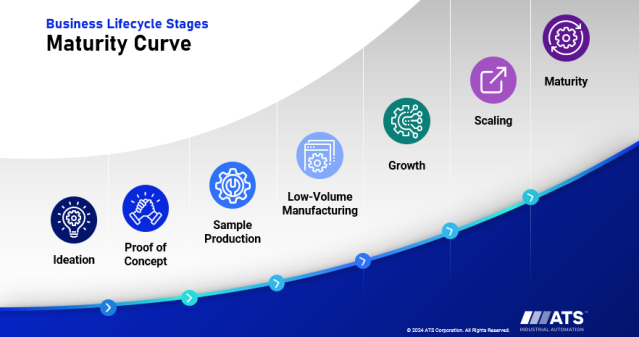

EVs: From Idea to Market: Volume Production to Scale-Up

Bringing an electric vehicle from an idea to market is also not easy. If you don’t believe me, take Elon Musk’s word for it. There are very few companies worldwide and fewer still in the US to bring a new vehicle to full production. And, while there are many who have produced prototype EVs in limited production, niche electric vehicles, getting those products to the broader market is incredibly challenging. Thousands of details need to be in place to produce a vehicle from an assembly line every minute and a half or so, and each one of these details is vital to vehicle performance and customer satisfaction.

Making sure you keep volume production in mind early in the product design cycle is key to positioning your company for production ramp-up, and so is ensuring that you’ve aligned with an existing manufacturing domain knowledge to reduce complexity and maximize vehicle performance.

Typical EV Product Development Lifecycle: Alpha, Beta, Gamma, Delta

You may be familiar with the typical EV product development lifecycle of alpha, beta, gamma and delta.

Alpha, or A sample, is the exciting step where new and creative ideas are brought to fruition from CAD or CAE to the lab and the prototype shop. Beta, or B sample, is the realization of the dream, and when the first vehicle models start rolling off the production capable tooling. But this isn’t the end of the journey, but where the absolute hell can begin. In gamma, or C sample, you need to see the production grow and rise to meet consumers demands. Finally, in delta, or D sample, finishing touches are applied to ensure the economic longevity of the product. But be aware that missteps or omissions at any stage in this process, in the product design or in the automation, can result in a failure to get the product to the market.

Alpha

Let’s talk about alpha. Alpha is the most critical stage for aligning the product design and automation supply. Designs developed in a silo, without accessing domain knowledge, won’t make it across the finish line. Product design for process capable solutions and manufacturing or assembly are critical even at this stage. Here are a few things to keep in mind. First, what battery technology to use, a cylindrical or a pouch battery? Both have economic and production pros and cons and risks along the way.

Cylindrical Cell or Pouch Cell Technology?

For those leaning towards cylindrical cell technology:

Which spots on the cylindrical cell have the most excellent chance of success for coupling to the module bus structure?

With thousands of individual bonds, this is a critical design consideration that will ultimately affect the module design and the pack layout.

For those considering pouch cells:

Which tab trim and bend profiles guarantee the best conditions for successful welding?

Will the module be an integral part of the vehicle structure, or will it be encased in an enclosure to form part of the chassis?

Does a skateboard design make sense?

Or, like many hybrids, will the pack need to be contoured to fit around many of the other vehicle systems?

Energy Density

Secondly, and related to this, is energy density. The success or failure of an EV is range, and every cubic inch not filled with batteries is volume not used to make the cars go farther. At the same time, battery packs are heavy, need to be structurally sound, and survive loading and vehicle crash testing requirements.

Thermal Management

Third, what about thermal management? As critical as the range is to a vehicle’s success, so too is the charging rate. Customers demand fast charging capabilities to maximize the utility of their cars and grant the freedoms of longer road trips. Similarly, the high-performance characteristics enjoyed by many EV production vehicles are only possible with the high rate of current discharge to the Electric Drive Unit (EDU). Both scenarios have heat generation in common.

How heat is dealt with is the core function of the thermal management system in the battery pack. Pack designers need to consider how best to distribute the cooling load over the pack; details like maximizing the thermal coupling to the cells, while designing a robust and long-lasting solution are critical. Consider also that gap filler is heavy and difficult to process, so optimizing this design element directly impacts the vehicle performance.

Safety

Safety is last, but certainly not least. Above all, electric vehicles must be safe not only to operate on the road, but also in production. Some process steps will inevitably prove more economical to complete manually, and the internal components of the pack must be designed to minimize the risk to operators on the assembly line. On the other hand, if your product design involves any form of thermal bonding, such as welding, making sure the cell is not damaged is crucial to safety performance in the field.

Thermal Propagation

Finally, thermal propagation in the battery pack needs to be considered, and we must ensure the appropriate burst valves for venting are in place.

Those are only a few of the things to think about at the very first stage of product design. Let’s say you get all these ideas solved on paper and even get some rough alpha builds completed in the lab. What does the machinery look like to achieve this in a production environment?

Beta

In beta, key process developments are turned into equipment and pilot lines are conceived and developed. Important questions are:

Is your automation supplier already familiar with your product and your desired performance metrics?

Will they know to replicate alpha level ambitions?

Without development at the alpha stage, many ideas are dead on arrival at the beta stage. Early unvetted ideas can end up being too complex, expensive or unreliable to make it into production.

Key areas of development at this stage include but are not limited to, securing the cells to the carrier. Important questions are:

How will cylindrical or pouch cells be secured to the carrier or module case?

Has the geometry of the carrier been designed to allow a high-speed precision dispense of an UV adhesive to the cylindrical cells?

Will the dispensing equipment be flexible enough to adapt to a new coverage pattern based on module performance in vibration testing?

For pouches, is there sufficient compression allowance in the stack to ensure that the product remains in close contact with the thermal conductors, while at the same time not requiring excessive press forces?

How is this compression maintained throughout the module assembly?

Welding

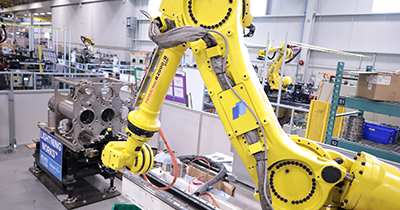

The cell welding process is one of the most critical process steps in the entire vehicle pack production. Welding produces some of the lowest resistance connections, resulting in higher energy efficiency and a reduced demand on the thermal system. But welding comes with some process risks. Consider that in a typical BEV cylindrical battery pack there can be upwards of 6500 cells strung together. Each of these cells requires a connection to positive and negative terminals, resulting in 13,000 individual weld sites. Each of these weld sites is critical to product quality; bad welds directly impact the vehicle performance.

In a production process with a 98% first time quality pass rate, a weld process with 13,000 welds needs to have a 99.98% success rate. What’s more, the process needs to be fast; 3D Galvo heads can weld very quickly. But the real trick is to have a robust automated clamping solution that reliably couples the bus strings to the cells, while at the same time accommodating module geometry. A Zero-Gap condition between the lattice structure and the cell surface is vital to a good contact weld.

Finally:

Has the automation solution carefully considered introducing shielding gas or non-conductive clamp solutions to isolate positive and negative terminals during the weld process?

Above all else, safety is an essential element during the laser welding process. Most of the critical operations occur in a black box or a class one laser enclosure, which prevents unwanted laser bounces from the process site into the surrounding workspace. So, enclosure design around the process is another area that automation suppliers need to keep in mind.

In the end, how are you sure that all of these factors have come together and worked out that you have a good weld? Blank testing might result in thousands of dollars in scrapped work in progress, until a weld problem is identified. Maybe one of the clamps in the matrix has failed, and there are now repeated weld failures on that contact site, over dozens of modules. What if you could know that there is an issue with welding in real-time? In-process monitoring is possible and needs careful development to generate the desired results. There are solutions to observe and measure the plume during the welding process, such as pulse phase thermography solutions, to analyze the weld connections internal resistance.

And finally, there is real-time in-process key home monitoring solutions that, when coupled with a few select welding companies, produce real-time results. This is groundbreaking technology and automakers need to ensure they work with an automation supplier who has embedded knowledge of these solutions, and where and how to use them. Of course, knowing this information earlier is better than later.

Important questions here are:

Do automation suppliers have the facilities and lab equipment available to support and test your process?

Can they demonstrate the process capability through real-time, in-process, test results?

It’s not uncommon to submit coupons or alpha level build components to the laser lab for process development. If your automation supplier has these capabilities, it only makes sense to continue this knowledge into a capable production equipment in the beta phase. This information is critical to move forward successfully into production.

Mechanical Alignment

Next, in the beta stage, and third on our list, is the overall mechanical alignment of the product.

Important questions here are:

Will the tolerance stack-up, of all the components in a batch pack assembly, support an automated process?

Can the pack be successfully mated to the vehicle chassis?

Should you rely on tooling features in the product design to achieve alignment, or on an adaptive automatic process, to cancel out the effects of tolerance stack-up?

Another critical consideration is that beta level components supplied to the automation house are often not yet in spec, as they undergo their own development lifecycle. This makes buying off and validating the automation equipment complex, as the line between product issues and machine capability is often not easy to distinguish.

As a customer, how can you ensure your automation equipment is functioning as promised, even before final production ready components are available? It’s been my experience that entire product lines have been designed, reviewed, procured, before even seeing a physical sample of some of the more significant components. This only highlights the risks in the automation design process and the challenges that can arise during equipment acceptance.

Thermal Management and TIM

Still in beta, what about the thermal management system and the equipment involved? At the core of the system is the cell bond to the cooling circuit. Although air is light, it’s a terrible conductor of heat, and thermal insulating material or TIM is used to fill the gap.

Various TIM materials are available, but they are also not generally fantastic conductors, need to be dielectric and are often expensive. These materials can be heavy, up to three times the specific gravity of water. The goal is to get the most surface contact with the battery cell and a robust connection, with as little gap filler as possible. This can require heavily customized automation tooling to achieve the thermal gap dispense. Some equipment lays down beads of TIM in a specific pattern on a cooling plate. Other solutions tend towards submersion of gap filler or an injection process. In either case, custom automation solutions are required to complete this critical performance process, to achieve a dielectric thermal conduction. TIMs often contain abrasive ceramic materials. These materials can produce considerable wear on components or need specialized dispense equipment to maintain functionality over time.

Finally, an in-process inspection of dispense media is essential to ensure there are no voids, and to provide feedback that allows the tuning of this process to optimize the amount of gap filler used. As mentioned, TIM is expensive, so make sure you’re not dispensing the bottom line into the battery pack without seeing the return. At this stage, the correct automation solution is required to ensure that dispensing equipment can remain flexible, reliable, and provide in-process specific metrics necessary for success.

Finally, in beta, developing test equipment at this stage is vital. Knowing that the modules and packs meet their desired metrics is essential to validate key processes, before ramping up into production. Whether incoming cell inspections such as open circuit voltage measurements, or leak testing the cooling circuit, each successful production line has online and offline testing to help minimize scrap and ensure a quality product.

Other essential testing requirements are likely to include the HIPOT test, DCR testing, and low voltage circuit testing to validate that the pack internal voltage monitoring system is functioning correctly. These tests require contact sites on the module or pack to have a design interface with the product and likely require custom connectors to ensure long-lasting and reliable connections. On the back end of testing is a databank of this information, so each product has a credible birth certificate right from the production floor to driving on the road.

Gamma

This brings us to gamma. Congratulations. If you’ve made it to gamma, you likely have a functioning EV at this point. And, while this is no small accomplishment, the next step into gamma is what separates the niche low-volume cars from the big players in the industry. If you’ve planned ahead of time, scaling production is difficult at best, and maximizing throughput will not be achievable if you have not. Gamma isn’t just about taking the lessons learned from the beta builds and ordering 10, 20 or 30 pilot machines to meet scale. There are factory level considerations not present during the beta stage. Consideration of the following material handling elements in early design will lessen the burden throughout this phase.

For example:

How will you quickly ferry a product from one process to another?

Have you made the best use of flexible and high-speed transportation solutions?

Will packs travel on tape guided AGCs to keep routing simple and predictable, or GPS guided AGVs to maximizing flexibility?

At the cell and module level, can you process cylindrical cells at 40 milliseconds or faster?

Do you have asynchronous automation handling to divert product that needs to be rejected?

If you’re transferring robotically, does your automation supplier have the in-house capabilities to simulate robot motions and demonstrate robot capability, before ever touching a product?

While it seems rudimentary compared to critical process development, material handling should be taken seriously and is ultimately the heartbeat of the production line.

Buffering

Thinking about buffering is next in gamma. This simple yet often overlooked element to volume production is key to maximizing throughput. Buffering is used to smooth out or eliminate production disruptions from various sources, such as machine downtime, component availability, or product rejects. Ensure your automation supplier can demonstrate line-level performance and illustrate where buffers or critical locations can drive throughput, without ever having to order equipment.

Part Matrix

The next one is one of my favorites, part matrix. At this point, if your automation line is expected to handle multiple part variations, and the product design has not considered the part matrix, it’s already too late. Every battery pack line I’ve worked on is responsible for making variations of the exact modules or packs; the more common you can make the components, the better.

Will you be building in batches, or is the expectation that packs will roll off the assembly line with an on-demand basis, or what is known as batch of one?

Consider what effect this will have on the buffering, multiple variants, and the constraints of the array of material inputs required. Handling multiple product variants also drives tooling complexity. It’s often more challenging to design one End of Arm Tool to take on various products, than to double the amount of equipment, but it may result in a higher upfront capital cost. And that’s just on the mechanical side. The controls architecture in the factory to manage batches can be incredibly complex.

Scheduling of material and tracking the build variations at each stage of the process step map involves using complex MES systems and a robust IT interface between the automation supplier and the factory. But on the other hand, having all material lineside can be a drain on footprint and traffic along factory supply routes.

Component Delivery

Speaking of component delivery:

How will incoming components arrive at the line?

Will they come directly from the dock and be driven via forklift, or will they come from an ASRS and be carried with AGVs to interface with the lineside automation and dunnage handling equipment?

More specifically, will the modules, coming out of what is likely multiple production lines for modules, have the coordination in place to get to the pack line on time and in the correct location?

Often these interfaces require coordination of various organizations. The automation suppliers need to have a broad understanding of the transportation experts in their field and ensure a smooth integration of automation and transport equipment, which is likely to occur for the first time on the customer’s assembly floor. These are just a few items in what is a hectic, complex time, during the gamma phase.

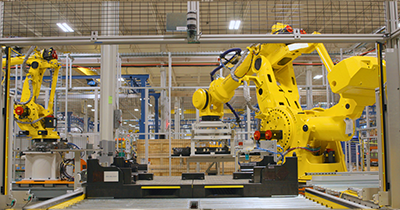

Putting it all together, auto manufacturers need companies like ATS, who are world leaders in understanding the battery assembly process. As vehicle electrification grows, we have led the way with our automation systems and test solutions. We have adapted our knowledge and experience from a broad range of industries and technology, to support electric motor winding and assembly, battery assembly and production, new drivetrain manufacturing solutions and various electronics and peripheral component production systems integral to the overall electric or hybrid vehicle.

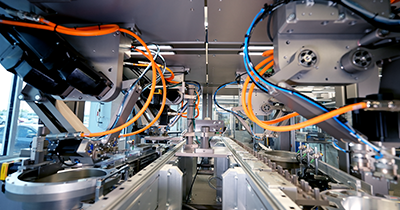

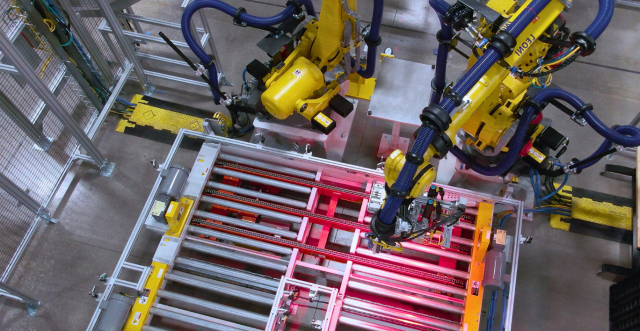

Shown here is a simplified process flow in a pouch cell modular assembly. ATS brings experience at each of these steps to ensure a successful product at the end. It’s in the gamma phase where this knowledge pays off. Incoming validation through proven and tested solutions, tab formation to fit tight customer requirements and what may be multiple form factors. We have a complicated array of assembly, including an interweaving of cells, compression pads, thermal conductors into a stack, ready to be married to the module case. While usually diverging in design from customer to customer, module builds hold similar elements of a stack compression before module build is complete.

Final Assembly

Finally, in final assembly the remaining components are added to the pouch modules.

Intelligent welding is a core competency at ATS, both directly on the cell tabs and any possible case welding. Our integration with suppliers, providing in-process solutions and our proprietary illuminate monitoring system, gives our customers a detailed look into the critical process step.

Finally, ATS’s fully capable testing division, coupled closely with our factory automation offerings, combines to ensure the product final quality check. While this workflow illustrates a beta or gamma level build cycle for pouch cells, the cylindrical path is very similar, with ATS providing key technology inputs along every step of the way. While it looks like this is the end of the automation road, there’s still one more critical step.

Delta

Finally, we’ve made it to delta, and there’s a production factory ready, willing, and able to crank out battery packs. Hallelujah! Consider the following delta level scenarios. Let’s say the test results from vibration have just come in and the mechanical integrity of the cell welding is marginal. Maybe the lattice geometry on the cell connection could be changed to add more weld path. Great idea. But some important questions are:

Can the automation accommodate this?

Does the automation supplier have the reactive skill sets and global footprint to retrofit the equipment before it becomes a much larger production issue?

Have cell weld clamps been designed to be modular, so that equipment updates can be made effectively as possible in the field?

Is the Galvo head responsible for the welding flexible and fast enough to handle the increase process scope?

In another delta scenario, one that’s more likely, the demand for EVs is so strong that we need to wring every second out of your existing substantial capital investment, to maximize throughput.

Does your automation supplier have real-time monitoring and analytics of the performance of the production line?

Can they make simple and low-cost recommendations to increase yield by that last one or two percent?

Or, can they recommend a small product design change to remove what is now an unnecessary component, saving both time and money?

These are just a couple of examples of how automation continues to play a role in the delta phase. Having a production line and support team that is adaptive is an important step in the long-term success of an automation program.

Partnership for Success

There are undoubtably many challenges, not just at the beginning or the end of an EV journey, but throughout the process. But it’s not a journey that automotive manufacturers need to take on their own; a shift in perspective is necessary.

The typical procurement model for volume automation equipment is no longer applicable. The industry is shifting from an automation supplier to an automation partner, to develop automation solutions as the product evolves concurrently. This is the only way to ensure that volume production is ready to go as soon as the product has stabilized and is the only way to address the overwhelming demand for EVs around the corner.

Imagine if, like in other industries, products were brought to a delta level and then the customer picked up the phone to solicit an automation supplier. ATS has the capacity, domain knowledge and experience to follow our partners from an early alpha stage right through to delta production and beyond. Throughout this process, ATS has a passionate team that can empower product designers to make the best decisions early and minimize disruptions as SOP nears.

The foundation of a partnership is a strong bidirectional trusting relationship where there are no ‘their’ problems or ‘my’ issues, only ‘our challenges.’ A partnership is also long-lasting and future-proof. They are making sure that both parties are stable and able to support each other over the product lifecycle. Another simple example is that a robust automation partner should supply a full suite of spare parts and deliver quickly on customer needs. An automation partner with the ability to scale operations is another critical benefit and ATS, with its global footprint, is up for the challenge. Partners also look out for each other by monitoring existing performance and improving existing equipment through digital interfaces like Internet of Things (IoT).

ATS is the leading global automation solutions provider. With a deep-rooted history in turnkey automation, and an ever-expanding capability set, ATS has the capacity and flexibility to partner around the globe, to work with our customers to reach common goals. We have 40 plus years of experience, have delivered thousands of turnkey automation lines, have a growing employee base of over 4200 team members, operate in 20 countries with 20 facilities and more than 50 offices. ATS is also a publicly traded company with strong financials, including $1.4 billion in revenue, and a $2.6 billion market capitalization. Finally, we’re a successful company, as we’ve enjoyed revenue growth and operational performance excellence over the past three years.

Specifically, ATS has a strong history of success and partnership within the EV industry. With 20 years of experience and more than 67 EV automation projects deployed, we are ideally suited for partnership in the industry. Some of our core competencies along the product evolution are listed here, and ATS continues to develop along with the industry.

High-speed cell handling.

Welding technologies.

Cylindrical, prismatic and pouch assembly.

Battery test capabilities: cell, module, pack.

Leak test capabilities.

Battery pilot line experience.

With this volume of completed projects, it’s clear that ATS has a strong partner base who have trusted ATS with the success of their electrification program. We’re excited to work with these companies in this constantly changing and challenging industry.

Finally, ATS wins with its partners, based on a few key fundamental principles. We have a great team, right from the initial sales through engineering, manufacturing, and service. We use the best in class components, combined with a substantial design library to leverage past experiences from a wide variety of industries. Excellent project management is key to maintaining the supplier customer relationship and keeping the bidirectional trust I mentioned earlier.

ATS: Your Stable Partner With a Global Footprint

I’m sure it’s clear by now that EVs are not a regional phenomenon and will be the future of the automotive industry. Wherever these opportunities manifest in the world, ATS has the global footprint to support and scale to meet our customer needs. Financial stability is also a key benefit to working with ATS, as you can be assured ATS will be around in the future to pick up the phone when service is required, or future expansion is needed to meet capacity.

I’d like to close by saying, on a personal level, how excited I am to be part of an organization that is shaping the future of the automotive industry. I see a bright future for what fully electric vehicles mean for our everyday way of life, not only for the obvious environmental and energy security reasons, but also for the pure driving enjoyment and mobility opportunities for upcoming generations. Because of this, it is clear to me and all of us at ATS that every day matters to bring this future to reality. But, with our partners, we need to act now to meet the demand.

So, the question is: are you prepared?

Thank you very much for your attention today and I look forward to working with you in the future.

Every project is unique. Allow us to listen to your challenges and share how automation can launch your project on time.